Navigating the festive season financially: A guide to refraining from debt and boosting your credit score

The holiday season – a time for joy, celebration ,and unfortunately, sometimes feeling pressured to overspend. It’s easy to get caught up in the magic of Christmas, but the financial hangover come January is far from enchanting. This alongside current financial challenges and price increases in relation to the cost of living crisis is far from ideal.

So this year, let’s embark on a journey to celebrate without breaking the bank. Here’s your guide to refraining from debt and even improving your credit score during the Christmas spending frenzy.

1. Set a Realistic Budget to avoid Christmas debt

The magic word for a debt-free Christmas holiday is “budget.” Determine how much you can comfortably spend without jeopardising your financial stability. Allocate funds for gifts, decorations and festivities, and stick to your budget religiously.

This means that you will only spend money that you have accounted for and will have no surprises post festive spending.

2. Consider thoughtful gifts to keep your bank balance happy this Christmas

Remember, it’s the thought that counts. Instead of showering your loved ones with expensive presents, focus on meaningful and thoughtful gifts. Consider handmade items, personalised presents, or even the gift of your time through shared experiences.

Memories made through a shared experience can be enjoyed for several years and can be more precious in the long run. Its could be something as simple as a group meal.

3. Cash is king when looking to avoid debt with your Christmas spending habits

Embrace the power of cash. When possible, use physical cash for your Christmas purchases. This helps you stay within your budget and minimises the temptation to overspend with credit cards. Avoid putting things on credit cards unless you intend or are in the habit of repaying this fully each month.

The most important thing being to always check your purchases against your set budget during the festive period.

4. Resist the Credit Card temptation to avoid racking up Christmas debt

While credit cards offer convenience, they also bring the danger of accumulating debt. If you must use credit, be strategic. Opt for cards with lower interest rates, and commit to paying off the balance as soon as possible.

This will also reflect greatly on your credit score as it will show your commitment to paying off debts in a timely and consistent fashion.

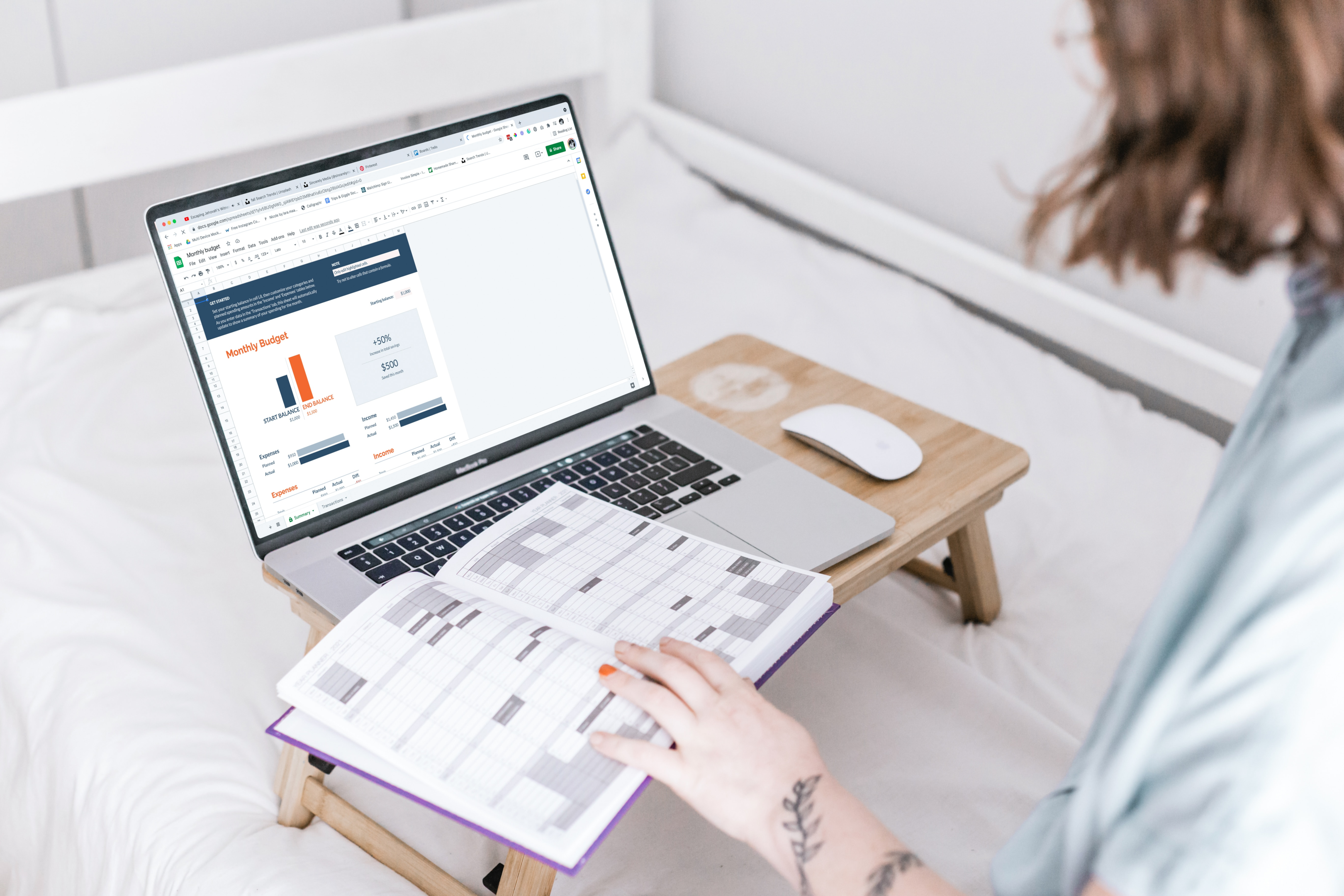

5. Track your spending over the festive period to avoid hidden expenses

Keep a close eye on your expenditures. Create a spreadsheet or use a budgeting app to monitor where your money is going. This awareness can help you make informed decisions and avoid impulsive purchases.

6. Prioritise debt repayment to avoid struggling financially post festive period

If you already have existing debts, prioritise repayment of these as a priority. Allocating a portion of your holiday budget to settle outstanding debts demonstrates financial responsibility and contributes to improving your credit score.

7. Avoid Retailer financing over the Christmas period to avoid running debts

Steer clear of store financing options. While “buy now, pay later” schemes may seem tempting, they can lead to increased debt and potentially impact your credit score negatively if you plan to apply for a mortgage in the near future.

8. Check your Credit Score over the festive season

Take advantage of the time off during the Christmas holiday season to check your credit score. Knowledge is power, and understanding your credit standing allows you to make informed decisions about your finances.

9. Plan for Next Year with smarter spending and budgeting

Consider opening a dedicated savings account for holiday expenses. Contribute a small amount regularly throughout the year, ensuring a stress-free and debt-free Christmas holiday season next year.

10. Educate and empower yourself to improve your spending habits

And finally Familiarise yourself with financial literacy resources. Understanding the basics of budgeting, credit, and debt management empowers you to make wise financial decisions, not just during the Christmas holidays but throughout the year.

This Christmas, let’s celebrate the season without compromising our financial well-being. By embracing a mindful approach to spending, you can enjoy the festivities while laying the foundation for a financially healthy New Year.

Cheers to a joyous, debt-free holiday season! This financial awareness will put you in good stead for 2024 and will have your credit score looking great for 2024. Perfect if you are looking to purchase a new home in the new year.

Mortgage advice and the options available to you

If this does sound like you the get in touch with The Mortgage Hub team directly on 01698 200050 or e-mail info@mortgagehub.co.uk